January 31, 2022

Brian Pasternak, Administrator

Employment and Training Administration

U.S. Department of Labor

200 Constitution Avenue NW, Room N–5311

Washington, DC 20210

Re: Employment and Training Administration, Department of Labor, Docket Number ETA-2021-0006, Proposed Rule on the Adverse Effect Wage Rate Methodology for the Temporary Employment of H-2A Nonimmigrants in Non-Range Occupations in the United States

Dear Administrator Pasternak:

The American Farm Bureau Federation is the nation’s largest general farm organization. We represent farmers and ranchers in all 50 states and Puerto Rico who are engaged in every conceivable facet of agricultural production. AFBF is pleased to submit comments in connection with the Department of Labor’s Proposed Rule on the Adverse Effect Wage Rate Methodology for the Temporary Employment of H-2A Nonimmigrants in Non-Range Occupations in the United States.

Across the country, farmers experience challenges in securing their workforce. Many farmers have turned to the H-2A guest worker program to help meet these labor demands, as evidenced through the continued growth in the H-2A program. Although more farmers are using the H-2A program, this is not an indication that the program is workable or user-friendly, but instead that domestically sourced labor is becoming scarcer. Many barriers prevent farmers from using the H-2A program, including the requirement to pay the Adverse Effect Wage Rate. AFBF urges the department to refrain from promulgating a final rule based on this proposed rulemaking, as it will compromise the ability of farmers to successfully continue agricultural production in the United States.

Agricultural work is physically demanding and often available on a seasonal or intermittent basis, making farm work unappealing to domestically available workers and contributing to agriculture’s growing labor shortage. In the absence of domestically available workers, the H-2A program continues to grow even though the program involves complex paperwork and subjects farmers to added regulations and costs.

Fiscal year 2021 (Oct. 1, 2020, through Sept. 30, 2021) was a record-breaking year for the H-2A program. During this time frame there were 317,619 total positions certified by the Department of Labor, marking the first time the program exceeded 300,000 positions. On a fiscal-year-over-fiscal-year basis, the total number of certified positions increased 15.3% in 2021 relative to 2020. Considering the growing demand for H-2A workers and the lack of interest to fill these positions by individuals already in the United States, DOL should refrain from moving forward with a rule regarding the Adverse Effect Wage Rate, as it is unclear if the population exists which the wage rate is intended to protect.

Additionally, the proposed rule fails to consider the drastic increases in the Adverse eEffect Wage Rate over the last five years. It takes no steps to incorporate market realities or the capacity of the American agricultural industry to absorb increasing labor expenses. The AEWR increases continue to outpace the rest of the U.S. economy. According to the FLS, the annual national average gross wage rate for field and livestock workers, the figure used for the AEWR, was $15.56 in 2021, up 94 cents, or 6.4%, from $14.62 in 2020. By comparison, according to the BLS’ Employment Cost Index, nationally, wages and salaries for private-industry workers increased 4.6% for the 12-month period ending in September 2021.

The sizeable 6.4% single-year increase for 2022 follows several years of considerable AEWR increases. Over the last five years, the national average AEWR has increased by 28%. In the 18 AEWR regions, wages have increased between 12% and 42% over the last five years. The proposed rule does nothing to moderate the growth of the AEWR or utilize mechanisms to produce a wage rate that enables farms to stay in business. Instead, DOL has proposed a wage methodology that perpetuates these drastic increases and uncertainty, worsening the outlook for food, fuel and fiber production in the United States.

The proposed rule would keep the single AEWR for the majority of field and livestock workers represented by six Standard Occupational Classification (SOC) codes while shifting AEWR determinations to the Department’s Bureau of Labor Statistics Occupational Employment and Wage Statistics (OEWS) survey (formerly the Occupational Employment Statistics survey) for all other occupations for which the FLS does not adequately collect or consistently report wage data at a state or regional level. DOL claims this is due to the department’s concern that using a single AEWR for all workers in the H-2A program may adversely affect wages in certain occupations. Considering the growth in the H-2A program due to a lack of domestic workers available to fill these positions, AFBF disagrees with the department’s assertion that the disaggregation of occupations is necessary to prevent adverse effect. AFBF urges the department to consider the administrative burden and financial impact these proposed changes will have on farmers. Furthermore, we disagree with the decision to utilize OEWS data for all other H-2A occupations except for the six SOC codes reported by the FLS, as the OEWS does not adequately represent the intricacies unique to the agriculture industry or include sufficient participation from farm and ranch employers in its data collection process.

The six SOC codes that maintain the single AEWR structure are: Graders and sorters, agricultural products, 45-2041; Agricultural equipment operators, 45-2091; Farmworkers, crop, nursery, and greenhouse, 45-2092; Farmworkers, farm, ranch, and aquacultural animals, 45-2093; Agricultural workers, all other, 45-2099; and Packers and packagers, hand, 53-7064. According to DOL, these six codes represent 98% of workers employed in H-2A job opportunities. However, there hasn’t been an annual public report on the program since fiscal year 2016. As a result, private analysts must rely on the data that is available in the FLS. The department should seek to promote transparency by providing the most up-to-date data to inform stakeholder input on proposed rules like this one.

Using the available FLS data, 90% of surveyed workers were classified as working one of the six job codes that will remain under the single AEWR structure. The remaining 10% of workers would now be subject to wages set by utilizing the OEWS source. Each SOC job code has a separate AEWR. However, these numbers could skew greater towards the OEWS wage determination as the proposed rule contains damaging language that requires agricultural employers to pay the highest applicable wage if the job opportunity can be classified within more than one occupation when those occupations are subject to different AEWRs.

Such language does not consider the realities of agriculture, in which employees are often engaging in a variety of tasks in a given day. For example, a farmer asks a worker who spends 80% of their time picking tomatoes, work in line with job code 45-2092 (farmworkers, crop, nursery, and greenhouse), to also move the truck that is being loaded with full crates of harvested tomatoes from row-to-row as harvesting is completed. In this scenario, the 20% of the time spent moving the truck is classified as work completed in line with job code 53-3033 (light truck driver).

In addition, the SOC determination could result in added workload at government agencies responsible for H-2A applications. It is also is unclear if there is a process in place if an agricultural employer disagrees with the SOC determination. Under the current application process for the H-2A program, the State Workforce Agency reviews job orders and their respective SOCs. As the job order moves forward, the OFLC Certifying Officer (CO) will review the employer’s application and job order, including SOC coding. The CO may determine a different SOC coding is necessary, for example, based on additional information received during processing. To determine the appropriate SOC code, the CO evaluates each job opportunity on a case-by-case basis, considering the totality of the information in an H-2A application and job order. AFBF is concerned that the process to determine the SOCs could create potential delays in the application process to obtain H-2A workers and does not provide a clear opportunity to challenge potential wage classifications.

Aside from the ensuing confusion and administrative burden created by the disaggregated wage structure under this proposed rule, this transition to using more OEWS data to calculate farmworker wages will increase labor expenditures for much of the agriculture industry that utilizes the H-2A program. While the proposed rule establishes that state-level OEWS wage rates will be utilized for establishing the position-specific wage rates when available, AFBF utilized national average wages rates for specific SOCs relative to the national average AEWR to examine the financial impediment that will result should DOL implement this proposed rule.

|

TABLE 1 |

||||||

|

2016 |

2017 |

2018 |

2019 |

2020 |

||

|

AEWR |

National Average AEWR |

$ 11.74 |

$ 12.20 |

$ 12.47 |

$ 13.25 |

$ 13.99 |

|

SOC |

Description |

2016 |

2017 |

2018 |

2019 |

2020 |

|

11-9013 |

Farmers, Ranchers, and Other Agricultural Managers |

$ 36.44 |

$ 38.62 |

$ 38.43 |

$ 38.63 |

$ 36.93 |

|

45-1011 |

First-Line Supervisors of Farm Workers |

$ 23.47 |

$ 24.11 |

$ 24.42 |

$ 25.25 |

$ 26.16 |

|

53-3032 |

Heavy and Tractor-Trailer Truck Drivers |

$ 20.96 |

$ 21.39 |

$ 21.91 |

$ 22.52 |

$ 23.32 |

|

53-3033 |

Light Truck Drivers |

$ 16.73 |

$ 17.12 |

$ 17.75 |

$ 18.52 |

$ 19.74 |

|

47-2061 |

Construction Laborers |

$ 18.22 |

$ 18.70 |

$ 19.40 |

$ 20.06 |

$ 20.67 |

Under the proposed wage methodology, wage rates for the five often-quoted SOCs are all significantly higher than the AEWR. It is evident that the larger the share of workers classified as completing jobs outside of the six SOC codes that will maintain the single AEWR structure, the more significant the overall salary increase outlays for H-2A participating farms. Considering the requirement for agricultural employers to pay the highest applicable wage if the job opportunity can be classified within more than one occupation, when those occupations are subject to different AEWRs, AFBF expects OEWS to be required for a significant proportion of farm employees.

In the proposed rule, DOL does not adequately describe the economic impact of the AEWR. According to DOL’s assessment, the total impact of the rule change would be fairly insignificant. “While the Department remains sensitive to concerns of employers regarding increases in the FLS-based AEWRs, the department believes… that the approach proposed in this rulemaking best allows the department to fulfill its statutory mandate. The concerns about AEWR increases also appear overstated when considering long-term historical trends in agricultural worker wages and the agricultural labor market.” DOL goes on to selectively quote USDA ERS: “[A]lthough farm wages are rising in nominal and real terms, the impact of these rising costs on farmers’ incomes has been offset by rising productivity and/or output prices,” adding that “labor costs as a share of gross cash income do not show an upward trend for the industry as a whole over the past 20 years.” A more complete quote of the ERS source reads: “[T]rends in labor cost shares differ by commodity. Labor cost shares have fallen slightly over the past 20 years for the more labor-intensive fruit and vegetable sectors, although they appear to have been trending upwards again in the past few years. On dairies and in nursery operations, both of which also rely heavily on immigrant labor, labor costs as a share of income are at or near their 20-year highs.”

AFBF strongly disagrees with the department’s viewpoint that concerns over AEWR increases are overstated. The department’s viewpoint is disassociated from reality, as labor costs on farms, especially labor-intensive nursery and greenhouse, fruit and tree nut, and vegetable and melon operations, are substantial. The share of labor costs for nursery and greenhouse farms is 32.8%, fruit and tree nut is 29.7% and vegetable and melon is 22.4%. This differentiation by subsector is important and relevant because it is these three subsectors that employ the vast majority of H-2A workers. The department lacks an appropriate understanding of the actual impact increasing the AEWR as described in the proposed rule would have on these farming operations.

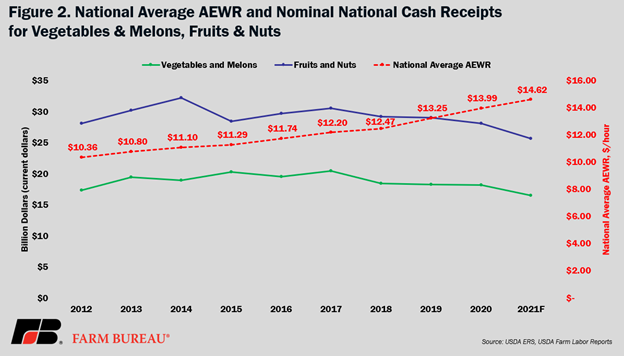

In these industries with higher than average labor expenditures compared to the broader agricultural industry, the capacity to recoup some of these additional costs in the marketplace is diminished. USDA’s forecasted 2021 cash receipts for fruits and nuts are 19% lower than 2017. USDA’s forecasted 2021 cash receipts for vegetables and melons are 16% lower than 2017. Meanwhile, the national average AEWR ($14.62) in 2021 is 20% higher than the national average AEWR ($12.20) in 2017.

The chart below illustrates how the current structure with a single average AEWR for all H-2A positions shows the deficit between labor expenditures and cash receipts for crops often planted and harvested by H-2A workers. Should the department make the damaging decision to move forward with this proposed rule, AFBF expects this deficit to continue to grow given the utilization of OEWS wages and lack of provisions to stabilize the destructive growth of the AEWR in recent years.

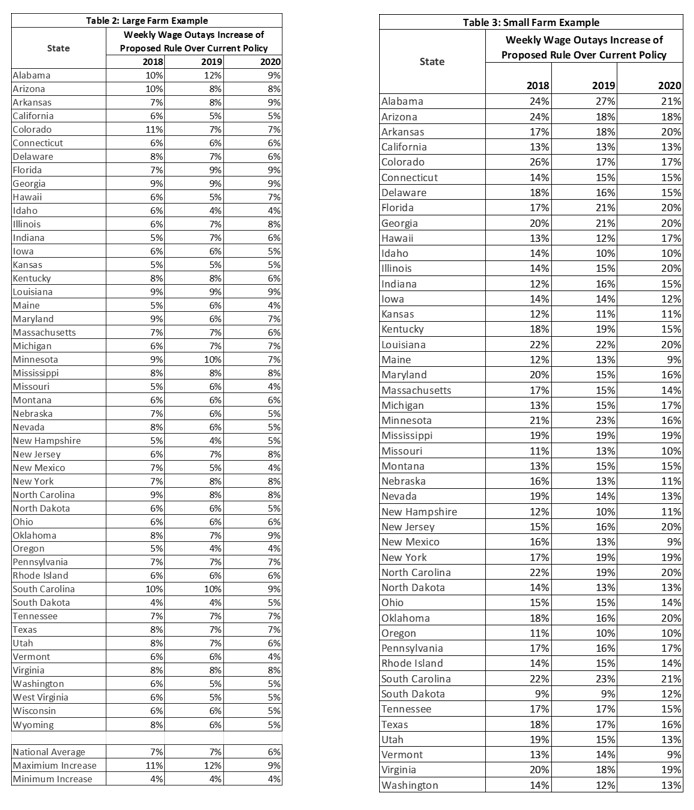

As discussed earlier, the overall financial impact of this proposal compared to the existing single AEWR structure would depend on the number of employees classified under occupations required to be paid OEWS wages. In AFBF’s analysis, the department’s wage proposal would increase wage expenditures for farms of all sizes, with small farms seeing an increase at a more significant percentage than larger employers. The percentage change in weekly outlays for both large and small farms is illustrated in the tables below. It is evident that farmers are unable to absorb the added costs proposed by the department under current economic conditions. Considering this, the department should abandon its efforts to move forward with this proposed rule and instead seek to develop an AEWR methodology that enables farms to remain in business.

Additionally, as farmers plan for the year ahead, it will be incredibly challenging to estimate labor expenditures, because wage determinations for occupations set by the FLS and OEWS are published at different times throughout the year. The department proposes to make the updated AEWRs effective through two announcements in the Federal Register, one for the AEWRs based on the FLS (i.e., effective on or about Jan. 1), and a second for the AEWRs based on the OEWS survey (i.e., effective on or about July 1), due to the different time periods for release of these two wage surveys. Potentially changing wage rates during peak periods in many regions of the U.S. makes it incredibly challenging for farmers to make important business decisions. Although farmers are generally price-takers, they make planting decisions based on expected input outlays and expected prices from wholesalers and other buyers. These decisions are made well in advance of planting and harvesting. Farmers’ existing contracts and price expectations cannot account for a significant change in the middle of the growing season as would occur under this proposal to have wage determinations be implemented at separate times. This could also result in added management burden. Some employees would receive mid-season wage increases per the OEWS publication, and others would not, potentially causing relationship issues among H-2A workers who live and work together. The varied publication and implementation dates for the FLS and OEWS surveys are yet another reason DOL should not move forward with this proposal and further exemplify that the department did not seek to propose practical wage requirements for implementation on farms.

In conclusion, the Department of Labor’s proposed rule on the Adverse Effect Wage Rate Methodology for the Temporary Employment of H-2A Nonimmigrants in Non-Range Occupations in the United States does not take into account the needs of American farmers and ranchers. Instead, it puts in place an administratively burdensome wage structure that will further increase labor costs for agricultural employers at a time when the cash receipts for the crops harvested on these farms continue to decline. This proposal does not reflect the realities of traditional farming operations where employees complete various tasks in a given day across multiple job classifications. Instead, this proposal seeks to silo each employee into a particular job classification. This approach will be incredibly damaging to producers whose employees occasionally engage in tasks related to truck driving, agricultural construction, and supervisory work that is otherwise not covered under the single AEWR codes.

As the department reviews the comments received in response to this proposed rule, it must prioritize implementing a final rule that does not create a more challenging environment to grow food, fuel and fiber in the United States. The H-2A program is integral to ensuring food production can continue in this country. However, domestic production will vanish if American farms are forced to operate at a loss due to a government-mandated wage rate and a lack of domestically available labor.

Sincerely,

Sam Kieffer